EMA Quarterly Market Snapshot – Dec 23

Highlights this quarter:

- EMA welcomes new Board members

- Renewed focus paves the way for greater participation and investment

- Reef Credit Scheme refresh on the way in 2024

- Engaging, learning and leveraging opportunities

- Reef Credit price guide

- About Reef Credit Scheme methods and credits

Merry Christmas

As we slide into December, Eco-Markets Australia (EMA) is pleased to be finishing the year on a high. 2023 has been a year of expansion, building and resetting as we look to supercharge the Reef Credit Scheme and continue to navigate the opportunities in environmental markets.

Before we sign off for the year, we wish to acknowledge the contribution and support received from the Technical Advisory Group, Directors and Chair of our Board, key partners, supporters, and friends throughout the year. Without this support the outstanding progress achieved during the year would not have been possible.

On behalf of the EMA team, thank you and best wishes for the festive season. We look forward to our continued collaborations in 2024.

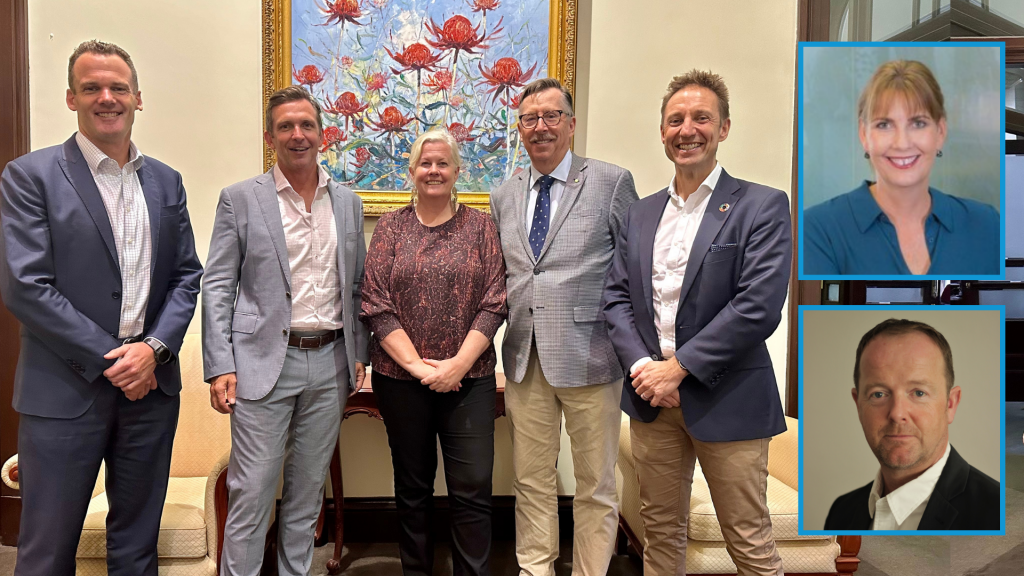

Welcoming new Board members

In November, we welcomed four new directors to the EMA Board. This high-calibre group of advocates bring a comprehensive set of skills and experience from a broad range of industry sectors, including agriculture, energy, finance, consulting, advisory, IT, and government.

Connecting this diverse group is their collective expertise and accomplishments in sustainability and ESG. They also share a commitment to elevate EMA’s impact in voluntary environmental markets and promote the critical role business can – and must – play to ensure the success of nature-based markets and long-term sustainability, with a focus on the Reef Credit Scheme.

EMA is pleased to introduce and warmly welcome:

- Rob Allen, CEO & Founder, nodl.io

- Ros Baker, Former CEO, Sugar Research Australia

- Prof John Cole, Advisor in Sustainability, Innovation & Regional Development

- Brett Spicer, Partner, Sustainability at BDO

On the flipside, we farewelled Vanessa Sullivan, who after two and half years of dedicated service to the Board, stepped down as a director. EMA wishes to acknowledge and thank Vanessa for her energy, commitment, and support of EMA and the Reef Credit Scheme. We wish Vanessa all the very best.

Renewed focus paves the way for greater participation and investment

One of the messages from EMA’s recently published Annual Report 2022-23 is the need for investors and businesses to play a part in filling the annual $700 billion financial gap needed to protect and restore nature. As Australia’s only independent environmental market administrator, we are supporting this priority through proactive engagement with project developers, landholders, and investors in the Reef Credit Scheme. Together we can elevate the impact that 44,768 kilograms of pollutant has been prevented, so far, from entering the waters of the Great Barrier Reef.

Halfway through this year, EMA experienced a renewed energy and focus with the appointment of Maree Adshead as CEO. The year also saw growth in our organisational capacity, together with expanded funding commitment from the Queensland Government’s Office of the Great Barrier Reef to supercharge the Reef Credit Scheme.

We’ve also done a lot of listening and we’re committed to clearing pathways to participation. Early in the coming year our focus will be on:

- A comprehensive review and public consultation of proposed improvements to the Reef Credit Scheme,

- Working hard to expand on methodologies,

- Building on strong stakeholder relations, and

- Evolving our registry and operations to ensure ongoing excellence in integrity, market confidence, and trust.

Looking outward, we find ourselves in interesting and exciting times. Last week the Nature Repair Market Bill passed through Parliament, providing the legislative framework for a voluntary Australian biodiversity credit market. Also announced was a new Nature Finance Council, which will focus on increasing private sector financial flows to benefit nature.

Biodiversity credit markets are seen as an innovative mechanism for driving private investment into biodiversity restoration, conservation and protection. The founding partners of the Reef Credit Scheme – NQ Dry Tropics, Terrain NRM, GreenCollar and the Queensland Government – had this in mind in 2017, and the understanding that governments do not have the resources to fund this work alone.

The lessons EMA would share from its experience administering the Reef Credit Scheme is that new markets must have transparency and sound governance; use robust data and science to quantify impacts; and that credit issuance is linked to verified high-integrity outcomes for nature, and for people.

Reef Credit Scheme refresh on the way in 2024

Since the launch of the Reef Credit Scheme six years ago, participants in the scheme have prevented more than 44 tonnes of dissolved inorganic nitrogen (DIN) and generated more than $2.7 million in returns. Like most pioneers we have learned a lot about what works well, and where there might be opportunities to improve. Building on this achievement and ensuring the continued integrity of the Reef Credit Scheme, EMA is currently reviewing the Standard the proposed revisions being released for comprehensive public consultation in February 2024.

To support market growth and maintain confidence in the scheme’s delivery of environmental and financial outcomes, EMA conducts periodic reviews to improve the Reef Credit Scheme. The current round of revisions is based on a combination of experience and learnings from operating the Reef Credit Scheme, plus stakeholder input since the previous review two years ago. During the public consultation period, EMA will also invite key stakeholders to participate and provide feedback. Gathering feedback is a critical part of the process to ensure the Reef Credit Scheme facilitates participation, is even more accessible, and continues thrive and succeed.

The expectation is to publish the updated Reef Credit Scheme in late April. In the meantime, for your opportunity to comment, please keep an eye out for your invitation in mid-February 2024.

Engaging, learning and leveraging opportunities

With more boots on the ground, the EMA team have been on the road taking every opportunity to meet stakeholders and attend industry events. We want to further learn and understand the opportunities to improve, grow and facilitate access to the Reef Credit Scheme and the opportunities around emerging nature-based markets.

Ranking high on the consolidated ‘to do’ list is raising awareness and providing a broad suite of information and education about the scheme. We want to help foster better informed decision-making, such as: how to participate, what are the benefits, the financial incentives, and more. We know our audience is diverse, so we will work with all stakeholder groups, such as methodology developers, project proponents, landholders, agribusiness advisors, government and investors.

If you’re located the Reef catchment area and would like more information about the Reef Credit Scheme, you’re welcome to contact, EMA Landholder & Market Liaison Liza Davis, who is based in Townsville. Liza can be contact by email or on 0419 858 142.

Reef Credit quarterly price guide

With growing interest in the Reef Credit Scheme so too is the price of a Reef Credit. During the December quarter the price movement has remained the same as the previous quarter where the Reef Credits issued under the Fertiliser Management method were sold for $100 per credit.

As the independent market administrator, EMA’s role is to oversee the administration of the Reef Credit Scheme and manage the scheme registry account. The registry tracks approved projects, verifies the outcome (i.e. the water quality improvement linked to an approved methodology), and issues, transfers and retires Reef Credits. EMA’s role is not involved in the financial negotiations between a buyer and seller of the Reef Credits. However, we understand the importance of providing a market price guide, which we will continue to publish in this quarterly newsletter.

About RCS methods and credits

There are currently three methodologies under the Reef Credit Scheme that can deliver a quantifiable pollutant reduction and generate credits. These are:

- Fertiliser Management – reducing the loss of dissolved inorganic nitrogen (DIN) by adopting soil and nutrient management practices from agriculture

- Gully Rehabilitation – reducing fine sediment loss from gully erosion by implementing landscape rehabilitation

- Waterwaste Treatment – reducing DIN in wastewater by applying a water treatment using live algae.

Reef Credit projects are typically a partnership between an environmental project developer and a landholder. Different methodologies generate different types of Reef Credits – either a DIN Reef Credit or a fine sediment Reef Credit. Each credit represents a specific amount in the reduction of the pollutant and could attract different prices from investors.

As the following diagram illustrates, using a sediment methodology, one Reef Credit is earned for every 538 kilograms of fine sediment prevented from entering the Reef catchment. Using a DIN methodology, one Reef Credit is earned for every kilogram of DIN prevented from entering the catchment.

If you’re interested in participating as a methodology developer or project proponent, please contact us by email or on 0437 264 608.

To subscribe to our newsletter, please enter your email here